Updated: February 2025

Wealth is not just for the privileged few—it is achievable for anyone willing to follow the right strategies.

Whether you are starting from scratch or looking to accelerate your financial growth, building wealth requires discipline, smart decisions, and long-term planning.

By understanding key financial principles and making strategic investments, you can create a path toward financial independence and security.

Becoming Wealthy: Is It Possible?

Many of us dream of financial freedom, yet wealth often feels like an unattainable goal—something reserved for the lucky few. But what if I told you that financial success isn’t about luck?

The truth is, that wealth-building is a process that requires strategic planning, discipline, and the right mindset. It doesn’t require a massive inheritance or a six-figure salary—just a solid plan and consistent effort.

Here are seven essential steps you can take to start building wealth today, regardless of your financial situation.

1. Establish a Reliable Income Stream

Having a steady income is the foundation of wealth-building. Before saving and investing, you need a reliable source of income.

There are three primary types:

- Active Income: This comes from traditional employment, where you trade time for money.

This includes full-time jobs, freelancing, consulting, and contract work.

- Passive Income: This is money earned from investments, rental properties, royalties, affiliate marketing, or other sources that require little to no daily effort.

Examples include dividends, rental income, and automated online businesses.

- Portfolio Income: Income generated from investments such as stocks, bonds, and mutual funds.

This type of income is essential for long-term wealth accumulation.

Action Steps:

✅ Increase your skills to qualify for higher-paying jobs.

✅ Start a side hustle to boost your income.

✅ Explore investment opportunities that generate passive income.

2. Eliminate Debt & Avoid Unnecessary Borrowing

Debt is one of the biggest obstacles to financial independence, but not all debt is bad.

Bad debt, such as high-interest credit card balances and payday loans, drains your wealth and makes it harder to save and invest. These debts often come with high interest rates and do not contribute to your financial growth.

On the other hand, good debt—such as a mortgage, student loan, or business loan—can be a strategic tool for building wealth when managed properly.

These types of debt help you acquire appreciating assets or increase your earning potential. The key is to minimize bad debt while leveraging good debt wisely to grow your financial future.

How to Eliminate Debt

- Use the Debt Snowball Method (paying off the smallest debts first for quick wins) or the Debt Avalanche Method (paying off high-interest debts first to save money).

- Avoid lifestyle inflation—don’t increase your spending just because your income rises.

- Use credit cards responsibly and pay off the balance in full each month.

- Refinance loans to lower interest rates if possible.

- Create a plan to eliminate unnecessary expenses and redirect funds toward debt repayment.

Becoming debt-free will give you more financial freedom to invest in your future and accumulate wealth faster.

3. Create and Stick to a Budget

A budget is a financial blueprint that ensures your money is working for you. It helps you track your income, expenses, and savings.

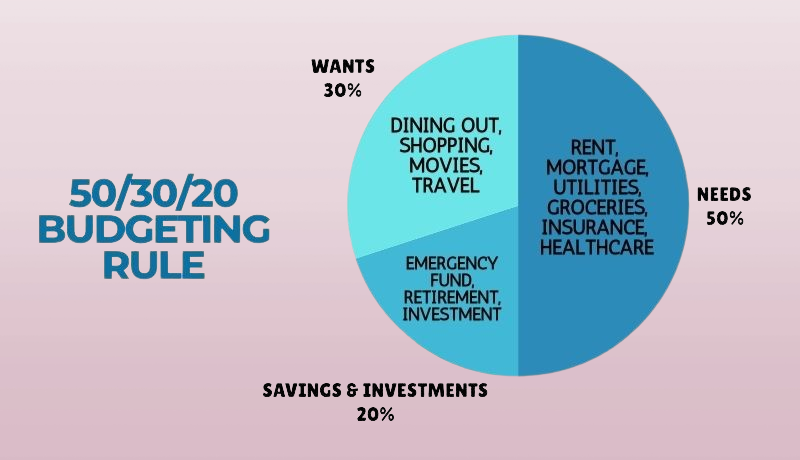

Budgeting Formula:

- 50% Needs: Rent/mortgage, utilities, groceries, insurance, transportation, healthcare.

- 30% Wants: Entertainment, dining out, shopping, travel, hobbies.

- 20% Savings & Investments: Emergency fund, retirement savings, investment portfolio.

Action Steps:

✅ Use budgeting apps like Mint or YNAB to track expenses.

✅ Set financial goals and align your budget accordingly.

✅ Review your budget monthly and adjust as needed.

By following a structured budget, you gain control over your spending and increase your ability to save and invest.

4. Live Below Your Means

One of the biggest mistakes people make is spending money they don’t have. Just because you can afford something doesn’t mean you should buy it.

Tips for Living Below Your Means:

- Differentiate between wants and needs.

- Avoid impulse purchases—wait 24 hours before making non-essential purchases.

- Cook at home instead of eating out frequently.

- Buy quality items that last longer instead of opting for cheap, short-term solutions.

- Save bonuses and tax refunds instead of spending them immediately.

- Downsize your lifestyle if necessary—rent a smaller place, drive a reliable used car, and cut unnecessary subscriptions.

By controlling your expenses, you create room for wealth accumulation and long-term financial security.

5. Focus on Acquiring Assets, Not Liabilities

Wealthy individuals prioritize buying assets—things that generate income—while minimizing liabilities.

For example, Warren Buffett, one of the most successful investors of all time, built his wealth by acquiring stocks in strong companies and reinvesting dividends.

Similarly, Robert Kiyosaki, author of Rich Dad Poor Dad, emphasizes the importance of acquiring income-generating assets like real estate and businesses.

Oprah Winfrey, through her media empire, transformed her earnings into ownership stakes in companies, further expanding her wealth.

These examples highlight how focusing on assets rather than liabilities can lead to financial success.

Understanding Assets vs. Liabilities

- Assets: Rental properties, stocks, businesses, bonds, dividend-yielding investments, intellectual property (patents, books, courses).

- Liabilities: Cars, credit card debt, personal loans, depreciating assets (e.g., luxury items that lose value over time).

How to Build Assets:

✅ Invest in real estate that generates rental income.

✅ Buy stocks and dividend-paying investments.

✅ Start a side business or develop intellectual property that generates royalties.

Instead of financing a new car or the latest gadget, invest in income-producing assets that will help grow your wealth.

6. Delay Gratification & Practice Smart Spending

Delayed gratification is a key trait of the wealthy.

Instead of spending money on short-term pleasures, focus on long-term financial stability.

How to Develop Delayed Gratification

- Avoid keeping up with the Joneses—don’t buy things to impress others.

- Think long-term—save for a home, investments, or business rather than splurging on luxury items.

- Build an emergency fund to avoid unnecessary borrowing.

- Prioritize experiences over material possessions.

Mastering delayed gratification ensures you stay on track toward financial independence.

7. Invest Wisely & Take Advantage of Compound Interest

Saving alone won’t make you wealthy—investing will. Investing allows your money to grow over time, thanks to compound interest.

Smart Investment Strategies

✅ Invest in index funds, stocks, real estate, and ETFs.

✅ Take advantage of employer-sponsored retirement accounts (401(k), IRA, Roth IRA).

✅ Learn about dividend investing—investing in stocks that pay regular dividends.

The Power of Compounding

Compounding allows your investments to generate earnings, which are then reinvested to generate even more earnings. The earlier you start investing, the greater the benefits of compound interest.

Bonus: Consider Starting a Business

One of the fastest ways to build wealth is through entrepreneurship. With the internet, you can start an online business with little to no capital, and platforms like Wealthy Affiliate provide step-by-step training to help you get started.

Whether you want to create a blog, launch an e-commerce store, or start an affiliate marketing business, Wealthy Affiliate offers the tools, resources, and community support needed to turn your ideas into a profitable venture.

Final Thoughts: Wealth with Purpose

Aspiring to become wealthy is not wrong.

Wealth itself is neither good nor bad—it’s how you acquire and use it that matters. Many successful individuals use their wealth to give back, support causes, and create a positive impact.

The key is to manage your finances wisely, live within your means, and invest in your future. When you build wealth with integrity and purpose, you not only secure your financial future but also contribute positively to the world.

Start your journey today—because financial freedom is within your reach!

Spot on, agree with the points you stated. In my opinion, it all starts with a burning desire. A desire, passion for something and persistence will eventually help you realize your wildest dreams!

Hi Faith,

You’re absolutely right!

Our success in almost every aspect of life depends on how much we really want it, for nothing is im[ossible if we put our heart to whatever it is we are doing or what it is we want to achieve.

Thanks for dropping by.

I’d say these 7 tips to becoming wealthy are very practical. I just hope more people will be enlightened and will know how to manage their finances better in order to be financially free eventually.

I agree; becoming wealthy is not wrong at all. Thank you for this post.

Hi Albert,

Thanks for stopping by and I’m just glad to be able to share some tips that anyone can apply in order to achieve their financial goals.

Cheers!

Hi, this is a good article but I would have to disagree with some of your points. If you’ve learnt well from Robert Kiyosaki and read his books, listen to his Podcasts properly, then you’ll understand what I’m going to say. I learn these all from him.

Firstly, the rich don’t get out of debt. They get into debt and leverage debt to create more wealth. I know this is hard to understand for many. But there’s good debt and bad debt. Bad debt will just keep taking money out of your pocket while a good debt will make you richer. For example, Robert borrows money (debt) to acquire assets and create positive cashflow for him which eventually make him richer.

Secondly, you shouldn’t save money because the more you save the more you lose. Market inflation and devaluing of your money is faster than you think. Instead, you should keep acquiring assets and cashflow. They are the things that will make you rich, not saving money.

Thirdly, the concept is not just about buying assets and never buy liabilities. You can buy liabilities but you should buy them using cashflows from your assets and not buying them using your own saved money.

There are a lot of concepts from Robert Kiyosaki that is misinterpreted in this post. I know there are a lot of things that are hard to understand. So I suggest everyone to study Robert’s books closely and understand his points first. I hope my sharing here helps. I’ve read a lot of Robert’s books and attended his live seminar too. These are what I learnt 🙂

Hey Jerry, thanks for your insightful comment. I have read Robert Kiyosaki’s Rich Dad Poor Dad and also several of his other books such as Cashflow Quadrant, Retire Young Retire Rich, Rich Dad’s Guide to Investing as well as the book he co-authored with Donald Trump and trust me, I understood very well what he’s trying to say.

And if you think there are a lot of his concepts that were misrepresented in this post, that is simply because I originally intended this article to be as short and simplified as it could be. Having said that, I could not possibly explain all of Kiyosaki’s points in such a short article so what I did was gleaned the more important ones. It was never my intention to misrepresent him.

You have to understand that not everyone can apply what Kiyosaki did, that is, get into debt and leverage debt to create more wealth. Since the target readers of my post are new investors, I want to be really cautious by not telling them to borrow money in order to create wealth. I’m not sure if you are aware but there are actually successful businessmen today who started their business with no capital at all, just their skills and wit, zero debts, no loans at all!

As to the matter of saving, when I said “save money,” I’m talking about building an emergency fund, we all need that, don’t you think? I’m sorry if it did not appear to you that way. Here’s the thing, If you invest all your money and your investment fails and you suddenly lose your job, where would you end up?

I truly appreciate your input Jerry and thank you for taking the time to get it heard.

I like the fact that at the end you reminded me that God is not against me being wealthy. Thank you for the great tips, simple and practical. It will take some work especially to get out of debt, and not knowing where to start makes it even harder.

Hello Motheo,

God is the ultimate source of blessings, spiritual and financial. God is a rich God; He owns everything including our lives (Psalm 24:1; 1 Corinthians 10:26) and I believe He wants to bless us financially.

Getting out of debt is a serious matter and many people struggle hard to become debt-free. Yes, often times we do not know where to start and that is why we should have a plan, execute it and stick to it. It will take a lot of discipline and it’s going to be a huge adjustment in our spending and lifestyle but it will all be worth it in the end. Consulting a financial adviser might help if we have tried many times and failed.

Thanks for dropping by.

Great tips that you have provided here! I have definitely applied many of those myself throughout the years. Also, I have noticed that I am not so interested to buy so much stuff… I like a minimal lifestyle. Quality over quantity. Nice share!

Hello Andrea,

There’s really nothing wrong with wanting to buy stuff but we should only buy things that we need. Warren Buffet said, “If you buy things you do not need, soon you will have to sell things you need.”

In reality, the road to becoming wealthy is not that narrow as many people might think.

Anyone can become wealthy by simply applying these 7 steps. It may take a little bit of hard work and of course discipline but it will all be worth it in the end.

hello there,

You give some very nice and useful tips that one needs to follow in order to achieve a financial freedom.

I totally relate to the things you mention.

It is very important to be able to invest wisely while at the same time save money.

Hi Asen, thanks for your comment.

I really believe that we all have the potential to better our status in life and achieve financial freedom. It may take a lot of life-changing habits but it will all be worth it in the end. The common problem I see among the poor and average people is that they have a vague understanding of how they can actually start accumulating wealth regardless of their present financial status. They think that they have to be rich first in order to start saving and investing. While you need to have a steady cash flow in order to have something to invest, you don’t have to have much. You can start with small amounts and increase it later on as your cash flow increases.

Investing is one topic that I would really like to focus on in my succeeding articles as I hope to spread financial literacy to those who do not know how and where to start.

You site is great. I really like how you described how health is wealth and how they are related to each other. i liked how you showed when you don’t have good health, then it affects your wealth, ability to earn income, and it is so true. I believe in preventative health too and being proactive with our health. Kudos to you. Great site and great information provided. thanks!

Hey Desiree, appreciate your thoughts so very much and I’m glad you find my site to be informative.

Staying healthy in order to become wealthy has become my new advocacy since my eyes were opened to the possibility of having a better and more fulfilling life by maintaining a healthy lifestyle and being wise in managing our finances. I used to be one of those people who held on to the motto that “life is short, have fun” and had the mentality that “only the rich are getting richer while the poor are getting poorer and the middle class are just that, middle class.”

I’m not really dreaming of becoming a millionaire but I believe that there are many things we can learn from the rich that we can apply in order to better our lives financially without forgetting that the greatest wealth we could ever have remains to be our health and most of all, our relationship with God and with our family and friends.

God bless!

It is great that you discuss about wealth correlation with the bible verses. God want us to be wealthy people. No wrong to being a wealthy person. Thanks for the enforcement in doing efforts to be a wealthty person.

Hi Melani, thanks for your comment.

Yes, God wants His children to live in abundance and there’s nothing in the Bible that says being a wealthy Christian is wrong. However, we have to exercise caution when it comes to wealth. We must first of all seek His kingdom and His righteousness (Matthew 6:33) which means, in everything we have to put God first. We strive to become wealthy but we must be clear with our reason and purpose for wanting more of God’s blessings. And that is to be a blessing to more people and to be able to support God’s work here on earth. We also have to always give the credit back to God because after all He’s the One who gives us the increase. God bless

I could really resonate with this article. I used to have a nice car and a big mortgage…..but then I went travelling for 6 months and my perspective changed entirely. On my return, it seemed ridiculous that I was paying £250 per month for a car and a whole lot more for a mortgage! I felt totally trapped. I now have a smaller, older car that I bought outright and am reluctant to buy another house!

It’s so true that’s its all about making your money work for you – I’d rather wait a few years, invest that money and rent somewhere cheaply than saddle myself with a huge mortgage.

Hey Louise. Because we’re not taught about money management. We don’t learn these things in school and from our parents. We only come to realize we’re doing everything wrong when we get to meet other people with different perspective on money and wealth. The good thing is that, we learn from our own mistakes and we can always change the way things are.

I believe that we all have the potential to become wealthy. We take the necessary steps to make our goal of becoming wealthy a reality. It maybe difficult at first especially if we will have to make major changes with regards to our spending and lifestyle. We just need to set a goal and stick to it, let’s set our eyes on the prize.

There’s a quote, “The rich remain rich because they live like they’re broke. The broke remains broke because they live like they’re rich.” There’s a lot of truth to this and this the one of the biggest mistakes that most poor and average people make. If we want to improve our life, we should learn from the rich.