As I’ve emphasized in previous blogs, investing is one of the most effective ways to grow your wealth and achieve long-term financial security. It’s about making your money work for you and generating more wealth over time.

Investing is not just about building personal wealth, it’s also a way to protect your savings against inflation, which can erode the purchasing power of your money.

In this guide, we’ll cover what the stock market is, how to get started with online stock trading, and the steps to building a successful stock portfolio.

Disclaimer: I am not a financial advisor. This post is for informational purposes only. Please do your own research or consult a professional before making any investment decisions.

What is the Stock Market?

The stock market is a marketplace where investors buy and sell shares of publicly listed companies.

In the past, investing in stocks required working with traditional stockbrokers, but today, online platforms have made it easier, faster, and more affordable to trade stocks from the comfort of your home.

All you need is a computer or mobile device with an internet connection and some capital to begin investing.

💡 Fun Fact: The first stock market was established in 1602 in Amsterdam when the Dutch East India Company issued shares to the public. This marked the birth of modern stock trading!

Understanding Stocks and Shares

Stocks, also known as shares, represent ownership in a company.

When a company wants to raise capital for expansion or new projects, it issues shares to the public through the stock market. Investors who purchase these shares become part-owners of the company and participate in its growth, earnings, and potential losses.

Why Do Companies Issue Shares?

Instead of taking loans from banks and paying interest, companies raise funds by selling shares. In return, shareholders receive a portion of the company’s profits in the form of dividends and potential capital gains.

How Do You Make Money in the Stock Market?

There are two primary ways to grow your wealth through stocks:

🅰 Capital Appreciation

This happens when the value of your stock increases over time.

For instance, if you buy a stock at ₱100 and its price rises to ₱200, your investment grows by ₱100. This is the principle behind the popular phrase, “Buy low, sell high.”

🅱 Dividends

Dividends are a portion of a company’s earnings distributed to shareholders.

These can come in the form of cash or additional shares. Companies issue dividends as a way to reward their investors and share the profits.

💡 Trivia: Warren Buffett, one of the world’s most successful investors, made his first stock purchase at just 11 years old. He advises investors to think long-term and focus on strong companies.

Steps to Start Investing in Stocks Online

Step 1: Find a Reliable Online Broker

To start investing, you need a stockbroker.

An online broker provides a platform for buying and selling stocks and often includes tools like research reports, investment guides, and educational resources.

When choosing a broker, consider these factors:

1. Fees: Look for brokers with low transaction costs, especially if you’re starting with a small capital.

2. Support and Education: If you’re new to investing, select a broker that offers webinars, guides, or even personal advice.

3. Reputation: Opt for well-established brokers with a solid track record.

In the Philippines, some reputable online stockbrokers include:

✔ COL Financial (www.colfinancial.com)

✔ First Metro Securities Brokerage Corporation (www.firstmetrosec.com.ph)

✔ BPI Securities Corporation (www.bpitrade.com)

✔ BDO Nomura (www.bdo.com.ph/bdonomura)

For a full list of accredited brokers, visit the Philippine Stock Exchange (PSE).

Recommended Broker: COL Financial

I personally use COL Financial, the largest online brokerage in the Philippines. They provide excellent educational resources, free seminars, and an Easy Investment Program (EIP) for beginners. While I’m not paid to promote them, I highly recommend them based on my own positive experience.

Step 2: Open a Trading Account

Once you’ve selected your broker, you’ll need to open a trading account.

This process is straightforward and similar to opening a bank account:

✔ Fill out the application forms.

✔ Submit the necessary documents (e.g., valid ID, proof of address).

✔ Fund your account. Most brokers require a minimum deposit of ₱5,000, although some allow you to start with less.

Step 3: Fund Your Account

After opening your account, transfer funds to your broker to start buying stocks. Remember, the more funds you allocate, the better you can diversify your investments to minimize risks.

💡 Did You Know? The stock market operates on emotions as much as it does on numbers. Fear and greed often drive price movements, which is why disciplined investing is crucial.

Step 4: Start Buying Stocks

If you’re unsure which stocks to buy, consider:

✅ Blue-chip stocks: These are shares of well-established and financially stable companies.

✅ Index funds: These track the overall market, providing diversification.

✅ Dividend stocks: Ideal for steady passive income.

Step 5: Place Your Order

Online trading platforms allow you to place orders directly, without speaking to a broker. Simply log in to your account, search for the stock you want, specify the quantity, and confirm your purchase.

Once your order is completed, you’ll receive a confirmation detailing the transaction.

Step 6: Monitor Your Portfolio and Adjust Your Strategy

Regularly track the performance of your stock portfolio to ensure it aligns with your financial goals. You may consider:

✔ Adding funds to strong-performing stocks.

✔ Selling underperforming stocks.

✔ Diversifying into different sectors to reduce risk.

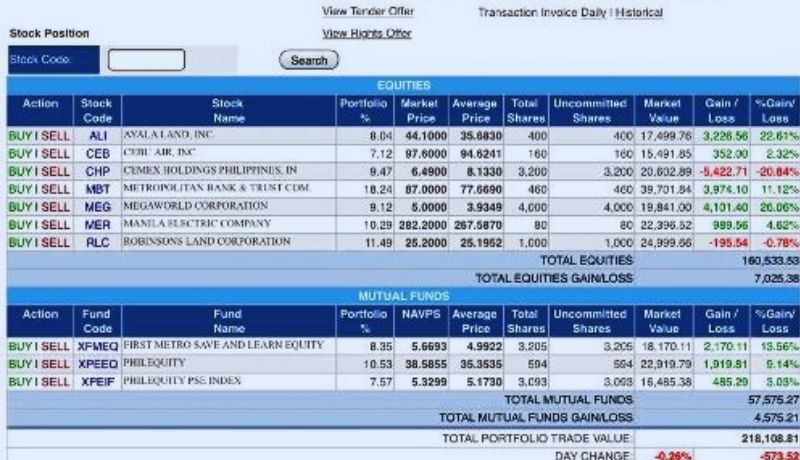

Here’s a snapshot of my personal stock portfolio from July 2017, showing both gains and losses. While some losses are inevitable, the long-term gains outweigh them.

Why Should You Invest in the Stock Market?

While there are various investment options available, history has shown that the stock market outperforms fixed-income instruments over the long run.

The power of compounding makes time your greatest ally in wealth-building. As dividends and earnings accumulate, they generate their own returns, accelerating your financial growth.

Yes, investing in stocks carries risks, but with knowledge, strategy, and patience, the potential rewards far exceed those of traditional savings accounts.

Key Tips for Beginners

1️⃣ Start Small and Be Consistent

Don’t feel pressured to invest a large amount right away. Begin with what you can afford, even if it’s just a few thousand pesos. Investing regularly, even in small amounts, allows you to take advantage of peso-cost averaging, reducing the impact of market fluctuations.

💡 Fun Fact: Peso-cost averaging is a strategy where you invest a fixed amount regularly, regardless of market conditions. This helps you buy more shares when prices are low and fewer shares when prices are high.

2️⃣ Diversify Your Portfolio

Avoid putting all your money into one stock or sector. Diversification spreads your risk across various industries and asset types. Think of it as “not putting all your eggs in one basket.”

💡 Pro Tip: Aim to include a mix of blue-chip stocks for stability, growth stocks for capital appreciation, and dividend stocks for passive income.

3️⃣ Set Clear Goals

Before investing, define your financial objectives. Are you saving for retirement, a child’s education, or a dream home? Having clear goals will help you choose the right investments and stay focused.

💡 Trivia: Studies show that people who set financial goals are more likely to achieve them compared to those who don’t.

4️⃣ Stay Informed but Avoid Overreacting

Follow market news and updates about your chosen companies.

However, don’t panic during short-term market dips—the stock market naturally fluctuates. Focus on long-term growth.

💡 Pro Tip: Warren Buffett’s famous advice is to “be fearful when others are greedy and greedy when others are fearful.” This highlights the importance of patience and emotional discipline in investing.

5️⃣ Leverage Free Educational Resources

Many brokers offer free webinars, tutorials, and guides. Take advantage of these to boost your knowledge and confidence as an investor.

💡 Trivia: Did you know COL Financial’s Easy Investment Program (EIP) is designed for beginners to learn and grow their investments steadily?

6️⃣ Reinvest Your Dividends

If you receive dividends, consider reinvesting them to compound your returns. This can significantly accelerate your portfolio’s growth over time.

7️⃣ Avoid Emotional Decisions

Fear and greed are two emotions that can lead to poor investment choices. Stick to your strategy and avoid making impulsive decisions based on market noise.

8️⃣ Monitor Your Progress, Not Every Second

While it’s essential to track your portfolio, obsessively checking it can lead to unnecessary stress. Set periodic reviews, such as monthly or quarterly, to evaluate your investments.

Conclusion

The stock market remains one of the best investment options for building wealth and achieving financial freedom. By starting today, you’re taking a step toward making your money work harder for you.

Remember, time is your greatest ally in investing, thanks to the power of compounding. Whether you’re aiming for capital growth, passive income, or both, the stock market offers opportunities for everyone—including beginners.

Have you started investing yet? If not, now is the perfect time to take action. The earlier you start, the better your chances of achieving financial independence.

I’d just like to give a shoutout to Sharebuilder. I suppose I don’t know how good they are nowadays, but years ago when I was new to investing they were who I went with and I never had any issues with them. And it was simple enough that 18 year old me could figure it out, so that’s gotta say something about the ease of use of their platform 🙂

Hey Jimmy,

With several online stock brokers to choose from, one of the things investors should consider is the ease of use of their platform. I ran a search on Sharebuilder but I was led to Capital One Investing website so I’m guessing they’re one and the same, they just changed names. But thanks anyway for mentioning, I’ll take a look at it.

Hi, I enjoyed your post, it’s very informative. Someone I consider a mentor talked to me about how he has invested in stocks online, I didn’t pay much attention then, but I really appreciate the details you explained, I feel I shouldn’t waste more time and look into the possibilities. I will come back for more info. Thank you 🙂

Hi Arlet,

I’m glad you find my post informative. I do not claim to be an expert when it comes to investing in stocks as I am also still learning myself. I just wish somebody told me all about this when I fist started working, that way I would have started investing as soon as I was making a stable income.

Anyway, I hope you would consider investing your spare cash in the stock market instead of just letting it sit in the bank. Just a reminder though, invest only the amount that you won’t be needing in the next 5-10 years.

Please do check back as I will be posting more articles about how you can invest in the stock market to make your money work for you and start building your wealth.

I just wanted to thank you for your in-depth information on the Stock Market, as I am a newbie to investing! I have always wanted to learn how to invest, but have been too terrified to do so! Finding a broker online always scared me, because it is so easy to impersonate someone… However, using a broker that has been tried and tested by others would make users feel safer for sure! So thanks for your recommendations! Now, as a Canadian, I have to ask: Do you HAVE to go through the brokerage firms from the Philippines, or is there US or Canada based ones as well?

Hi Janice,

Thanks for your comment.

They say that investing in the stock market is risky and I say there’s some truth to that. But one thing that we need to clarify is that trading is different from investing. As an investor, you’re here for the long run which minimizes your risk of losing money.

I can’t blame you for being scared to invest in the stock market with the aid of online stock brokers but as long as you go with those who are known for their good reputation, you will do just fine.

There are a lot of trusted online brokers in the US and Canada. If you are in the US, you may want to check out TD Ameritrade (the number 1 ranked broker of 2017), Fidelity (the lowest commissions and bet tools for research), E*TRADE, TradeStation, Ally Invest and Merrill Edge. In Canada, Questrade, Optionsxpress and Interactive Brokers are the best online brokers.

I hope this helps.