Mid-year is the perfect time for a financial reset.

Think of it as a wellness check—not for your body, but for your bank account. You wouldn’t wait until something’s wrong to visit the doctor, and the same goes for your finances. A quick check-in now can save you from scrambling come December.

Whether you’re crushing your savings goals or feeling like your budget’s been on autopilot, a mid-year money checkup gives you a chance to pause, reflect, and pivot if needed. And trust me, even a simple 20-minute review can help you avoid costly surprises, revive forgotten goals, and find peace of mind.

Why Mid-Year Financial Reviews Matter

Taking stock halfway through the year can be both eye-opening and empowering. Maybe you’ve been diligently stashing away for that emergency fund. Or maybe those spontaneous Amazon orders have been slowly eroding your budget. Either way, now’s the time to regroup.

Here’s why a mid-year financial review is a smart move:

- Prevent surprises: Spot issues like rising expenses or missing savings goals before they become big problems.

- Celebrate progress: Recognize what’s working. Small wins—like reducing debt or sticking to a grocery budget—deserve credit.

- Reset with purpose: Life changes. Maybe you started a new job or had unexpected medical expenses. Adjust your financial game plan accordingly.

💡 According to a 2024 report by Fidelity, people who regularly check in on their finances are 44% more likely to achieve their financial goals than those who don’t.

Step 1: Assess Your Financial Progress So Far

You don’t need a finance degree to evaluate where you stand. But you do need honesty, a little math, and maybe a cup of coffee.

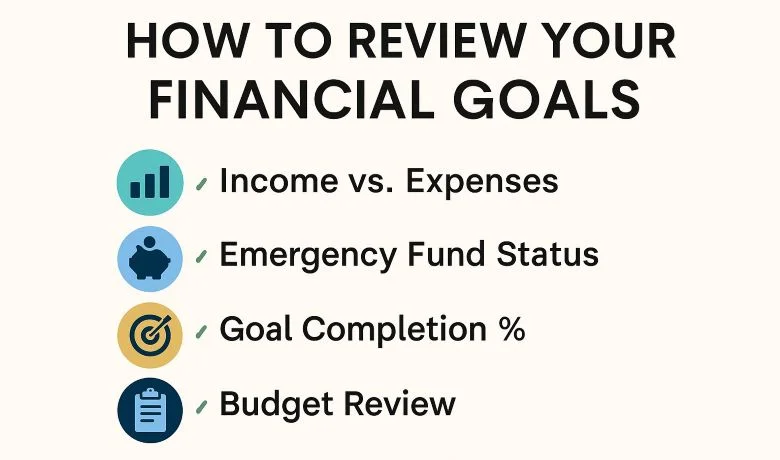

✅ Key Areas to Review:

1. Financial Goals Check-In

- Are you on pace to reach your 2025 savings, debt, or investment goals?

- Revisit the goals you set in January—do they still align with your priorities?

- Use the 50/30/20 rule as a loose benchmark: 50% needs, 30% wants, 20% savings/debt repayment.

2. Cash Flow Analysis

- Are you living within your means?

- Review your bank statements or use free budgeting tools (like YNAB or Mint).

- A positive cash flow—where your income exceeds your expenses—is essential for long-term wealth-building.

Learn how healthy side hustles can increase your income and improve your well-being.

3. Spending Habits Audit

- Identify “leaks” in your budget. Streaming subscriptions, impulse buys, and takeout can add up fast.

- Try categorizing your expenses and calculating what percent of your income goes to each.

- Look for red flags: increasing credit card balances, shrinking savings, or frequent overdrafts.

4. Emergency Fund Status

- Financial planners suggest having 3–6 months’ worth of expenses saved.

- Even a $1,000 cushion is a solid start and can protect you from relying on high-interest credit cards when unexpected costs arise.

Step 2: Realign & Reignite Your Financial Goals

So, your checkup revealed a few bumps in the road. That’s okay. Progress isn’t linear, and perfection isn’t the goal—consistency is.

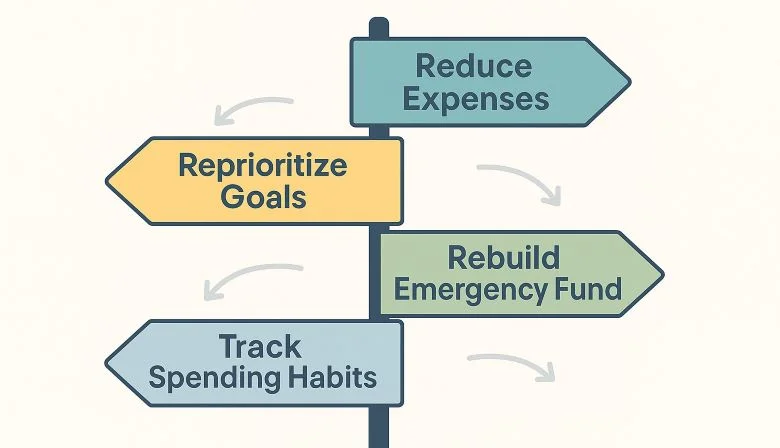

🔁 Try These Smart Mid-Year Adjustments:

✂️ Trim Non-Essentials

- Look for subscriptions you forgot about or rarely use.

- Eat out one less time per week and direct the savings to your emergency fund or debt.

- Small changes, like packing lunch instead of dining out, can have a lasting impact.

For more ideas, check out our post on passive income strategies that help you earn while staying healthy.

🎯 Re-Prioritize Your Goals

- Life changes—your goals should, too. Maybe paying off a credit card now takes priority over saving for a vacation.

- Pick your top 2–3 financial goals to focus on for the rest of the year.

📅 Automate Where Possible

- Set up automatic transfers to savings or retirement accounts.

- Automating payments reduces missed deadlines and removes decision fatigue.

🔐 Build Financial Resilience

- Set up sinking funds for irregular expenses (e.g., car maintenance, holidays).

- Gradually increase your emergency fund by just $10–$50 a week.

📈 Adjust Your Budget

- Use the zero-based budgeting method to assign every dollar a purpose.

- Check for seasonal expenses in the second half of the year (back-to-school, holidays).

🧠 A study from the National Endowment for Financial Education found that those who adjust their budgets mid-year are significantly more likely to reduce financial stress and stay on track long-term.

Step 3: Set Yourself Up for a Sustainable Financial Future

It’s not just about surviving this year. It’s about building a life where you’re financially secure, flexible, and free.

🧭 Think Long-Term, Live Smart Today

🧱 Layer Your Goals

- Short-term: Emergency fund, debt payoff.

- Mid-term: Down payment, vacation, car upgrade.

- Long-term: Retirement, college funds, financial independence.

🔄 Revise Your Financial Plan Regularly

- Big life events (marriage, a new baby, job change) mean big shifts in your money plan.

- Revisit your goals quarterly or after major milestones.

📱 Use Financial Tech Wisely

- Apps like Personal Capital, Monarch, or Rocket Money can give you a financial dashboard at your fingertips.

- Consider scheduling a mid-year consultation with a financial advisor—even a virtual session can provide clarity.

Key Takeaways

- A mid-year money checkup is like preventive care for your finances—quick, essential, and often eye-opening.

- Focus on progress, not perfection. Realignment isn’t failure—it’s wise stewardship.

- Track your cash flow, adjust your goals, and build flexibility into your plan.

- Use technology and automation to make financial management easier and more consistent.

- Small changes now can lead to big wins by year’s end.

FAQs: Mid-Year Financial Reviews

Q: How often should I do a financial checkup?

A: At least twice a year—mid-year and year-end. However, reviewing your budget monthly can help you stay even more on track.

Q: What if I didn’t set financial goals at the beginning of the year?

A: No worries! Mid-year is the perfect time to start. Begin with one or two goals that matter most to you—like saving $1,000 or paying off a small credit card.

Q: How do I know if my budget is working?

A: If your income covers your needs, you’re saving regularly, and your debt isn’t growing, you’re doing well. But if you’re consistently overspending or dipping into savings, it’s time for adjustments.

Q: What’s the best app for tracking spending?

A: It depends on your style! Mint is great for beginners, YNAB (You Need A Budget) is ideal for hands-on budgeters, and Monarch Money is perfect for couples or families managing finances together.

Ready to Take Control of Your Money?

A mid-year financial review is your chance to take back control—before the holiday season sneaks up or resolutions roll around again. Even if your year didn’t start strong, it’s not too late to finish financially confident.

💬 What did you learn from your mid-year money checkup? Drop a comment or share your biggest “aha” moment—I’d love to hear it!